We’ve insured thousands of carpenters and builders over the last decade, and we’re proud to be the carpenters insurance experts.

Whether you’re a chippie who’s just registered their ABN, or an established builder, we have an experienced team to help you with quotes and expert advice.

For a quote or more information call us on 1800 808 800 or click the button below. Continue scrolling to read through our carpenters insurance guide.

Carpenters Insurance Guide

We specialise in carpenters insurance and can help you with a range of cover including those listed below.

Click an insurance type to jump straight to the relevant section:

- Public Liability Insurance

- Tool Insurance

- Personal Accident Insurance

- Contract Works Insurance

- Commercial Motor Insurance

- Other Insurance Types

We offer competitive premiums, quality coverage, award-winning service and claims support. Every client has their own dedicated account manager who is a fully qualified insurance broker.

In this guide we’ll run through the different types of carpenters insurance available, which carpenters actually need insurance, along with some important next steps.

We’ll also look at what’s involved for carpenters making the leap to builder, and how Trade Risk can make the insurance process easier.

Which Carpenters Need Insurance?

All carpenters can benefit from some forms of insurance, but when it comes to those who really need to have it, we are mainly looking at subcontractors and those running their own carpentry businesses.

Whether or not you need insurance such as public liability or personal accident insurance will depend heavily on the building sites you work on and the construction companies you do work for.

Many of these sites, especially the larger ones, will have mandatory insurance requirements for self-employed carpenters.

But… regardless of whether the sites you work on require insurance, having public liability and personal accident insurance is vital for any self-employed carpenter, or any tradie for that matter. Without insurance you’re taking a massive financial risk.

We’ll take a closer look at some of the most popular forms of carpenters insurance next.

Public Liability Insurance

When it comes to carpenters, public liability insurance is the one form of cover which is most commonly required.

This form of insurance can protect you financially if your work activities result in property damage or personal injury to another person.

Claims can range anywhere from the very minor, such as a few hundred dollars for a window you’ve broken, through to the very serious, such as a person being killed or seriously injured as a result of your work.

Without public liability insurance, a carpenter could face financial ruin if a large claim was to occur. Even a relatively small claim could wipe out a couple of months’ profit. With the right insurance in place you can rest easy.

Public liability can also provide limited cover for faulty workmanship, which can be very important for carpenters.

In most cases cover is limited to property damage or personal injury as a result of the faulty workmanship, and not the rectification of the faulty work itself.

For example if you built a pergola that collapsed due to a mistake you made, the policy would respond in the event that a falling beam injured someone below, but it wouldn’t cover the replacement or rebuilding of the pergola.

You can find out more about public liability insurance for carpenters by following the link to our dedicated page, or click the button below for an online quote.

Personal Accident Insurance

As self-employed carpenters are not covered by sick leave, and in most cases workers compensation, many worksites have mandatory requirements for income protection or personal accident insurance.

Personal accident insurance can replace a large portion of a carpenters income in the event that he or she cannot work for a period of time due to injury or illness (depending on the option selected).

One of the common claims we see from carpenters involve nail gun incidents, and the picture to the right shows the x-ray of one of our clients who made a successful claim.

A nail through the wrist can put you out of action for more than a month, making income protection very important.

For more information please visit our personal accident insurance guide or click the button below to request a quote.

Tool Insurance

Unfortunately thefts of tradie’s tools are becoming all too common.

Plenty of people would blame the so-called ‘ice epidemic’, and they’re probably not far wrong…

There are plenty of ways to protect your tools, but ultimately if someone wants them badly enough, there’s a good chance they’ll get them.

So that leaves tool insurance as the best way to protect yourself.

For some unknown reason tool insurance seems to get a bad wrap in online forums and social media, with people saying it is very expensive and difficult to claim on.

This couldn’t be further from the truth. In our experience tool insurance is one of the cheaper forms of insurance for a carpenter, and we deal with enough claims to know they do go through smoothly in the majority of cases.

The policy will cover your tools in the event of theft from a secure location, accidental damage, damage caused by fire or lightning, and damage caused in a vehicle collision or rollover.

To claim all you need is a police report, evidence of ownership (purchase receipts preferably) and replacement quotes.

It can take a few weeks for a claim to be finalised and paid, but waiting a couple of weeks and getting paid is a whole lot better than not getting paid at all.

Please note we can only offer tool insurance when combined with public liability.

Contract Works Insurance

If you’re taking on your own carpentry or building projects, it may be time to consider contract works insurance.

This form of insurance can cover a range of risks including:

- Loss or damage to your project due to fire, storm or malicious damage

- Loss or damage to materials on the work site

Whilst that’s not all the policy will cover, those are the main risk we are protecting against.

The main difference between contract works and public liability insurance is that it’s more about protecting yourself rather than a third party.

Public liability covers you for damage caused to property owned by a third party, whilst contract works can cover loss or damage to property either owned by you, or that you’re contractually responsible for.

Contract works is available as a single-protect or annual policy. If you’re only doing one or two project a year, the single-project policy may be best. Otherwise the annual policies covers all projects for the year.

Contract works can be a more complex policy, and the above information is very generalised. We strongly recommend speaking with one of our brokers regarding this form of insurance.

Commercial Motor Insurance

Where would a carpenter be without his (or her) ute?

It carries your tools and often carries your materials, and without it you’d be hard-pressed to keep on working and earning.

Of course you can get car insurance for your ute, van or truck from anywhere these days, but there are benefits to arranging it through Trade Risk.

Aside from the convenience of having us manage all of your business insurance types and the ability to combine them into a single monthly payment, we can also arrange more comprehensive cover.

If you have your ute insured with someone like NRMA or AAMI, you’ll have a basic policy that is the same as any other road user.

But as a carpentry business owner, you might find that the cover is a little slim compared to what you could get from a proper commercial motor insurance policy.

Areas affected could include your fit-out (such as ladder racks, shelving and built-in tool boxes) as well as signage if you have a full wrap on your vehicle.

This guide will help to explain the benefits of a proper commercial motor insurance policy compared with a standard car insurance policy for a tradie.

Other Forms of Insurance for Carpenters

Whilst it is not a mandatory form of insurance, many carpenters also have tool insurance in place to protect their tools.

A decent tool insurance policy will cover the cost of your tools if they are stolen or damaged through fire, storm or a vehicle collision.

How much cover do I need?

For most insurance types this will depend on what you’re protecting.

Tool insurance for example will be whatever the replacement value of your tools is. Personal accident insurance will be based on your taxable income, etc.

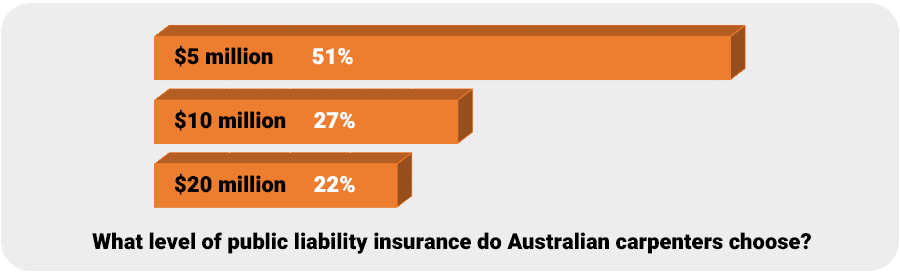

For public liability insurance however it’s a bit more of a mystery to most carpenters.

If you have contracts with builders that stipulate a minimum amount it makes things a little easier. For example if your contract states you need $10 million cover, then that’s what you need.

But if you have no idea whether you need $5m, $10m or $20m, which do you choose? Even as insurance brokers we’re unable to recommend an amount which is right for you.

What we can do however is let you know which level of cover is most popular with carpenters overall, so you can at least see what other chippies are going with.

Our figures show that just over half (51%) of carpenters go with the minimum $5m cover when using our online system. 27% choose $10m and 22% choose the maximum $20m.

So whilst $5m is the most popular, nearly half of all carpenters are going with a higher amount.

In most cases the increase in premium for $10m or $20m public liability is fairly small for a carpentry business, so it’s certainly worth considering taking the higher cover for greater peace of mind.

Things to look out for

No matter what types of cover you are considering, there are a few things to look out for which are specific to carpentry.

Formwork

If you are undertaking any formwork it is vital that you let your broker or insurance company know.

If the amount of formwork is less than 50% of your overall work you should still be able to obtain a standard policy, but you’ll still need to let us know.

For carpenters undertaking more than 50% formwork you may need a specialised policy, however this is still something that Trade Risk can assist you with.

Building licence

If you operate under your own building licence you will also need to let us know.

This won’t affect your ability to obtain insurance, but we still need to know as some insurance companies won’t cover carpenters with their own building licence.

If you are subcontracting to someone else who has a building licence there is no impact on your insurance.

Using subcontractors

The use of subcontractors can also have an impact on your insurance, especially if subcontractors make up more than 20% of your total turnover.

If you use subbies on any of your jobs please let us know so that we can ensure the policy we recommend to you is suitable for your needs.

All three of the issues raised above, being formwork, building license and subcontractors, relate to your public liability insurance only.

They also relate to all brokers and insurers, not just Trade Risk. So even if you don’t go with us, they are still important points to ask your broker or insurer about.

Chippies love Trade Risk!

We take a lot of pride in the high level of service and competitive premiums that we offer to carpenters.

Independent global review company Feefo collects ratings and reviews from all Trade Risk clients, and we are pleased to have a customer satisfaction rating of over 98%.

You can view the reviews and ratings from our clients by visiting our client reviews page, or directly on the Feefo website. You might be surprised to see how glowing in their praise carpenters can be about a humble insurance business!

Here are a couple of our favourite recent carpenters insurance reviews:

“Great service and knowledge by the team, perfect for tradies wanting to get insurance cover knowing that it’s specialised for tradesmen.”

James | Builder | NSW

“Very helpful and answered any questions I had. Excellent service and nothing was a problem. A pleasure to talk to.”

Graham | Carpenter | QLD

“From the get go, staff were very helpful in guiding me in the right direction for construction formwork insurance. Thanks again!”

Mark | Carpenter | NSW

“Great service every time. Always a pleasure to deal with. Been my go-to for many years now, will be back again next year.”

George | Builder | NSW

Sound too good to be true? Every one of them has been independently verified by Feefo as a genuine review from a genuine client. You can read all of our reviews on our Feefo Trade Risk page.

Carpenters Insurance Quotes

Here at Trade Risk we specialise in insurance for carpenters and can assist you with quotes on a range of different insurance types.

Our team of insurance brokers are experts in their field and will work together to ensure you have the right package to suit your needs as well as your budget.

For more information about our carpenter insurance, give us a call on 1800 808 800 or hit the orange button below.