Most trade business owners will know what public liability insurance is, but have you heard of run-off cover?

It’s a big deal, but one that doesn’t get spoken about much when it comes to tradies. It can result in a big claim being declined if you don’t get it right though…

Run-off cover is only applicable for someone cancelling or not renewing their insurance, and not replacing it with another policy.

If you’re not planning on cancelling or letting your policy expire, you can save yourself some reading as this won’t be applicable to you.

So what is it then?

To understand what run-off cover means to a trade business owner, first you need to understand how a public liability insurance policy works.

Public liability is an occurrence-based form of insurance. This means that to make a claim, you must have a current policy at the time that the incident occurs.

Many incidents will occur whilst you are working, therefore having a current policy at the time of undertaking the work is important.

However not all incidents occur at the time of doing the work. If an incident occurred a few months after you undertook the work, and by then you had cancelled your policy, you would not be covered.

Run-off cover is a form of insurance that allows you to remain protected even after you’re no longer running your business.

What if I’ve closed or sold my business?

You might think that once you close or sell your business that you can wipe your hands of any liability, but that is not always the case.

The next section has been put together as a general guide, but we strongly recommend you obtain legal advice before making any decisions on your risk exposure.

If you operate as a Pty Ltd company and close it down completely, going through the full deregistration process, you might remove any liability, provided that the work was undertaken whilst operating as a company.

But you must fully deregister the company. If you cease trading, but still leave the company sitting there, then the company can still be sued at any time and you’ll be left exposed.

Often your accountant will recommend that you keep the company alive, even if it’s not trading, so that you can start using the same company again if you switch back to being self-employed.

This isn’t bad advice as it will save you money in setting up a new company, but it does mean you remain exposed.

This article talks more about the issues when deregistering a Pty Ltd company and how it can affect the need for run-off cover.

Sole traders

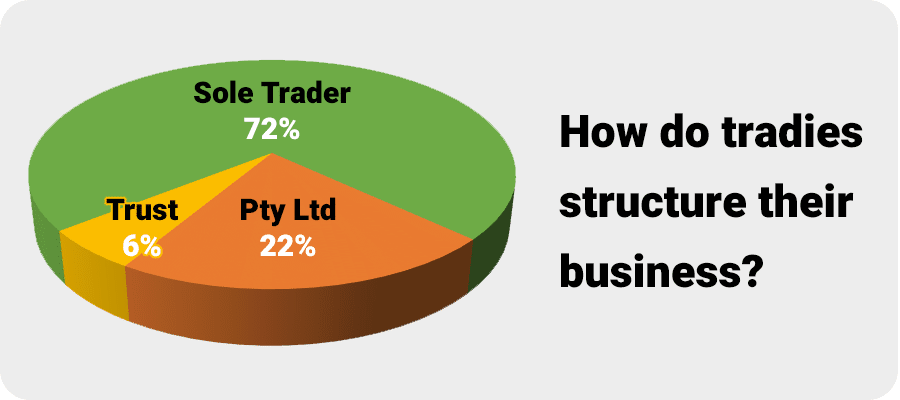

For those operating their business as a sole trader, which our data reveals is the majority of self-employed tradies, the risk is much greater.

Even if you deregister your ABN, you (as a person) are still the same entity and could still be sued years after you’ve ceased trading.

As a sole trader there is no way around this, so without maintaining your insurance (via run-off cover) you could remain exposed for years after ceasing trading.

You can find a very useful article about this very subject for sole trader here.

Examples

We’ll stat off with some very simple hypotheticals, before moving onto a serious real life example.

Example 1 – Carpenter

A carpenter operating as a sole trader replaces a set of stairs, and at the end of the job everyone is happy with the work and moves on.

A few months later the stairs fail as a person is using them, and suffers a serious injury.

In the meantime, the carpenter has gone back on wages and cancelled their public liability insurance.

Because the occurrence is when the stairs failed and the injury was sustained, not when the carpenter built the stairs, there is no cover.

Even though the carpenter has deregistered their ABN, they are still the same entity and are open to legal action.

Example 2 – Electrician

An electrician undertakes some rewiring work at a home, which all seems fine at the time.

A year later there is an extensive fire at the home and one of the occupants is killed. The investigation finds that faulty wiring completed by the electrician caused the fire.

Since completing the work the electrician has taken another job on wages, but left their Pty Ltd company sitting dormant in case they go back to self-employment. They let their public liability lapse after they stopped completing work under the Pty Ltd.

Because the occurrence is the time of the fire, and not the time of the electrical work being completed, the electrician has no cover.

Real life example involving a fatality

Back in 2008 there was a well-publicised deck failure in Brisbane that resulted in multiple serious injuries, and sadly, a loss of life.

A builder who completed work on the property in 2001 was subsequently sued (along with a building inspector) for over $1 million by the family of the deceased.

Furthermore, others who suffered serious injuries in the collapse also sued for hundreds of thousands of dollars each.

The dates here are very important. The work was completed in 2001, the collapse happened in 2008 and the legal action didn’t happen until 2012.

Even if the builder had all the appropriate insurances in place in 2001 at the time of the work, the only thing that matters (when it comes to public liability) is that he had cover in 2008 when the collapse occurred.

That’s a seven year gap, which is quite significant. Legal action didn’t commence until 2012, but it wouldn’t matter if the builder had public liability at that time. The date of the occurrence is all that matters.

We don’t know if the legal action was successful, or how much (if any) the builder had to pay, but the fact that it went to court means that many thousands of dollars in legal fees (at the very least) would have been incurred.

One of the great things about public liability insurance is that it covers defence costs even if you are not found to be liable.

Planned Cover have an article which also talks about this same incident and the need for run-off cover for tradies and trade businesses.

But I’ve heard you can still claim…

You can still claim on a public liability policy which has been cancelled or expired.

But…

It all goes back to the occurrence-based nature of public liability. If the incident occurred whilst the policy was still current, you could claim even after the policy was no longer current.

But if the policy was not current at the time of the incident, then you couldn’t claim.

This is illustrated well by the example above, where legal action wasn’t taken for four years after the occurrence, but it’s still the occurrence date that matters.

Above all, it’s important to remember that the time you undertook the work, and the time of the incident, are two very different things.

Run-off cover

So what is public liability run-off cover? It’s a form of insurance that continues to cover you after you have ceased trading.

It can differ from one insurer to the next, and will differ depending on your own circumstances, but broadly speaking it will get less expensive each year as your risk of a claim diminishes with time.

There is no specific timeframe requirement, but seven years seems to be a figure that is commonly mentioned.

We understand that most trade business owners will scoff at continuing to pay for public liability insurance for seven years after they cease trading, but as insurance professionals it’s our job to let you know about the potential risks.

Some brokers might tell you that a tradie doesn’t need run-off cover for public liability, but this article from the highly respected Professor Alan Manning (a legend in the insurance world) argues otherwise.

If you’re interested in run-off cover we’re here to help. We can answer your questions and obtain quotes for you. Contact your account manager or call our office on 1800 808 800.