For a lot of tradies, once they finish their apprenticeship one of the first things they think about is going out on their own.

This may be as a subcontractor, possibly still working with the same company, or out there on your own as a small business owner.

No matter which way you go, there are a few decisions to make when making the switch from wages to self-employed.

In this guide we’ll look at the initial steps involved, some of the options to consider and what happens next.

- How to start a trades business

- Do I need a licence?

- Business structures

- Insurance

- Marketing

- Accounting

- Growing

How to start a trades business

Before anything else you need to think about whether or not life as a self-employed tradie is right for you.

This is mainly from a financial perspective. Are you confident you’ll be able to keep the money coming in? Do you have enough of a buffer in case it takes time to build up?

We won’t dwell on this subject too much, and will assume if you’ve made it as far as reading this guide, you’ve already decided that it’s what you want.

We’ll go into a great level of detail within this guide, but it’s worth first outlining the absolute basics if you want to start trading on your own:

- Register an ABN as a sole trader

- Apply for a licence if your trade requires it

- Take out a public liability policy

- Get working!

That’s a super-simplified version, but they really are the basics if you just want to start taking on some jobs of your own.

Read on as we go into far more detail on starting your own tradie business…

Do I need a licence?

Not all trades in Australia require a licence, and frustratingly the requirements often differ from state to state.

So one of your first jobs should be to find out what licences (if any) you require, and to ensure you are eligible for that licence.

This may seem obvious, but we have seen a few cases where people have setup a company and taken out insurance, only to find that they didn’t actually qualify for an electrical contractor licence in Queensland.

This is quite specific to Qld electricians given the special licence requirements, but whatever your trade and your state, best to check the licence requirements first.

The government runs a website called the Australian Business Licence and Information Service, which allows you to search for any trade or business type and see if a licence is required.

The site is pretty clunky, but it’s a great place to start. The building authority for your state is also a great plate to get information. We’ve listed the links below:

- Queensland Building and Construction Commission

- NSW – Fair Trading

- Victorian Building Authority

- Tasmanian Government – Consumer, Building & Occupational Services

- SA Government

- WA Building Commission

- ACT Government

- NT – Building Practitioners Board

Another great idea is to simply ask other self-employed people in your trade what licenses they have.

It’s not wise to rely 100% on what they say, but it’s another good option in the overall information gathering process.

Business Structures

Getting your business structure right from day one is desirable, but many tradies choose the cheapest and easiest option to get going, which is as a sole trader.

There’s nothing wrong with this option, and you can always change to a partnership, company or trust depending on how your business evolves.

Getting started as a sole trader is incredibly quick and cheap.

Step 1 – Apply for an ABN (which is free!)

Step 2 – Apply for a business name if you’re not operating under your own name.

Step 3 – Done!

If you don’t need a registered business name it’s possible to setup a sole trader structure for free, and if you do want a business name, it’s only around $30 per year.

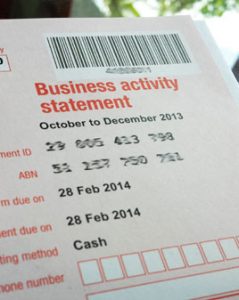

You’ll also need to register for GST (Goods and Services Taxation) if you expect your annual revenue to exceed $75,000.

There is no cost involved in registering, but it does mean you’ll have to start submitting BAS (Business Activity Statement) reports to the ATO every quarter.

The next step up from here is to operate as a company. That means having the ‘Pty Ltd’ on the end of your business name.

We’ve already written an extensive guide on the sole trader or company question, so we recommend checking that out.

On that basis we won’t say too much more about company structures.

If you are considering operating as anything other than a sole trader, it is recommended that you speak with an accountant about what’s best for you.

Insurance

One of the main reasons that tradies, or anyone else, switches to self-employment is to attempt to improve their financial situation.

It’s certainly not the only reason, but it’s right up there.

So what’s the point of putting in all this effort, only to risk losing everything? And by everything, we mean everything!

As a self-employed tradesman you’ll now be responsible for all of your actions, as well as those of anyone you employ.

If your work results in serious injury or death of another person, you could be up for hundreds of thousands, if not millions of dollars in damages.

This would send many a tradie bankrupt, but it can all be avoided with public liability insurance.

Public liability is the first type of insurance you need to consider when switching to self-employment, and it’s the one that will save the family home if things go wrong.

We’ve put together a comprehensive guide on public liability insurance which you can find by following the link.

You’ll also need to consider insurance for your tools, your vehicle and whatever else you have for your business.

One of the things you’ll be saying goodbye to when switching from paid employment is sick leave, and in most cases workers compensation.

So if you can’t work due to sickness and injury, you’ll be on your own.

Personal accident insurance will help you in this situation, and really is a must for self-employed tradies.

Marketing & Branding

At this point you should be across all the major issues, such as licensing, business structures and insurance.

Now we get into the more interesting parts of running your own business, which is branding and marketing.

How you go about this will depend on how you’re going to run the business.

If you’re a carpenter for example, and all you plan on doing is subcontracting to builders you already know, there’s really not much to do.

Potentially you could do absolutely nothing in terms of branding and marketing. No logo, no stationery; just an ABN and an invoice book!

If on the other hand you’re an electrician and you’re chasing direct business from residential and business clients, then you definitely need to put some effort into marketing.

This could be a whole article on its own (and eventually will be), but here are the basics:

- Come up with a unique business name that is available to register

- Register a domain name to match your business

- Get a logo designed

- Have business cards and letterhead designed and printed

- Get a website, even if it’s very basic to start with

- Start a Facebook business page

We have a guide on online marketing for tradies which would be worth checking out at this point.

In terms of logos, we used a company called 99designs for the Trade Risk logo. We love the logo and their pricing is very sharp. Follow the link to check them out.

Another fantastic way to promote your trade business in your local area is with vehicle signage.

At Trade Risk we have a wrapped ute we use for branding. It’s not cheap to get a vehicle fully wrapped, but it definitely has huge impact.

As a tradie you’re out on the road a lot, so why not have a big billboard rolling around all day?

Local tradie directories and job sites are quite an obvious place to start advertising your trade business, but do they work?

Lurk around tradie Facebook groups and you’ll get a lot of different options!

Some of the websites seems cheap, but if they deliver no work, it’s wasted money regardless of the cost.

Many tradies also complain that some of the sites are full of cowboys quoting prices that no qualified tradesman could compete with.

We can’t comment on that, and all you can really do is ask around and experiment for yourself.

We do have a guide however, titled ‘Are trade directories worthwhile?’. It’s a few years old now, but still worth a read.

Accounting

You might not be thinking a lot about accounting at this stage. After all, you need to make a few dollars before you can account for it!

It is something to think about early though, and can make life a lot easier down the track.

A lot of tradies and other micro-business owners will start off by using Excel to track their payments. That’s if they use anything at all!

Excel is a good start, but if you want to be serious about your business you should consider using a cloud-based accounting system.

At Trade Risk we’ve used Xero from day one. It costs very little per month, but saves us hours of work every week.

With over 3,000 clients we’re not that small now, but once upon a time we were a tiny one-man business too!

Around this time it’s worth finding an accountant if you don’t already have one. They can advise you on business structures and accounting systems.

Growing

By the time you get to this stage you should have your licensing sorted, your business structure decided upon and setup, and your accounting under control.

There’s a lot to think about when it comes to growing a trade business.

Are you happy carrying on as a single-person subcontractor, or do you want to grow into a genuine business with a team of tradies working for you?

There’s a real push out there for “getting off the tools”. Essentially, this means employing tradesmen to work for you, whilst you concentrate on growing the business.

It’s the old “work on the business, not in the business” line.

Plenty of tradies are happy to work on their own as a subbie, or run their own maintenance business with just themselves and a single ute or van.

There’s absolutely nothing wrong with this, and it certainly avoids a lot of financial stress when you don’t have to worry about paying other peoples’ wages.

How you want to grow your business really depends on what you want from it, but ultimately, as with most things, if you want the greater rewards you need to take the greater risks…

Disclaimer

We hope you’ve enjoyed this guide and get some benefit from it.

Remember though, at Trade Risk our only specialty is insurance. We’re licensed to provide advice on insurance and nothing else.

Whilst we certainly know a thing or two about accounting and business, it is vital that you refer to an account or suitably qualified professional before making any decisions. Do not rely on this article alone.

Happy trading!