Insurance for your tools of trade

If one or more of your most important tools were lost or stolen, could you turn up to work the next day and keep working?

Most tradies can’t work without their tools, and if you’re a subbie or self-employed tradesman that means that you can’t earn any money for yourself or your family.

Without tool insurance you would have to dig into your own savings to replace your tools, or worse still you may have to borrow the money from somewhere.

Protect your tools with insurance

The best option for protecting your tools is to have an appropriate tool insurance policy in place.

Tool insurance can be included in your public liability policy, and will cover the replacement costs of your tools if they are stolen or damaged.

In our experience tool cover is one of the most commonly claimed on forms of trade insurance, so it certainly pays to have some cover in place, especially considering how inexpensive the cover can be.

Not all policies are the same

When comparing tool insurance quotes it is very important to remember that not all tool insurance policies cover the same events.

Theft

When it comes to theft, which is the major concern for most tradesmen, many policies are quite different in terms of the cover they offer.

Some policies cover your tools regardless of how they are stored, some cover your tools only if they are stolen from a secure location, and some policies don’t even cover theft at all.

Accidental Damage

There are also differences when it comes to accidental damage. Many policies only cover accidental damage when it is caused by a vehicle collision or rollover, however there are some policies which will cover a broader range of accidental damage causes.

When taking out like insurance it is absolutely vital to read the PDS (product disclosure statement) to ensure that the cover you are getting is what you expected.

Is tool insurance worth it?

We look after more than 5,000 self-employed tradies, and whilst many of them do have tool insurance, more than half don’t have it.

You can only assume that those who don’t have tool insurance, don’t think it’s worth it.

Back in 2020 we put together a report titled Does tool insurance even pay out? This report looked at some of our claims data from the hundreds of tool claims we have assisted with.

You can follow the link to view the report, but what we found it that the average claim size had steadily increased in the years from 2015 to 2019.

In 2015 the average tool insurance claim size was $3,578 and by 2019 it had grown in $4,410.

Many tradies could comfortably cover that amount it they needed to, but the cost of insurance for that level of cover wouldn’t be much more than $400 a year, so effectively the cost to replace the stolen tools would cover around ten years’ worth of insurance.

Are your tools likely to get knocked off more than once every two years? Plenty of tradies might go their entire career without a theft, but we’ve had clients who’ve been cleaned out more than once within just a few years.

Going without tool insurance

There are still plenty of tradies out there who think they can do without tool insurance in order to save a few dollars each week.

Of course we think that all tradesmen should insure your tools, but if not then we at least recommend you read this article that we’ve put together on ways that you can protect your tools.

Which trades are most likely to suffer tool theft?

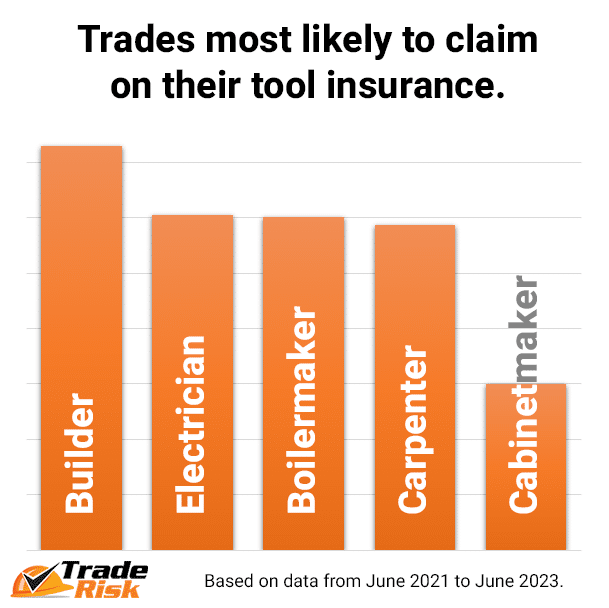

In 2023 we ran a report to look at which trades were most likely to claim on their tool insurance.

Our numbers showed that builders were most likely to claim on their tool insurance, followed by carpenters, boilermakers and electricians.

Now you might be thinking that “builder” isn’t a trade, which is true, but from an insurance perspective we’re more so looking at the business description rather than the trade.

We actually had more tool insurance claims for carpenters and electricians compared with builders, but that’s simply because we have more policies for carpenters and electricians.

How much should I cover my tools for?

It is important that you insure your tools for their full replacement value. That’s not the price you could sell them for on eBay, but the price you would have to pay if you had to purchase each and every tool again.

Don’t just think about the big power tools, remember all the little bits too, as these can add up very quickly when their replacement cost is used.

Just as important is insuring for the correct value, is being able to prove your ownership of the items in the event of a claim.

You can only claim for tools that you can provide evidence of ownership for. This is generally in the form of receipts or invoices, however the insurance companies may accept alternative forms of evidence in some cases.

Do have to list each tool separately?

Each insurer has slightly different rules. Some require all tools over $1,000 be listed on the policy, whilst others have a threshold of $2,000 or $3,000.

The amount will typically be listed on your policy documents, but if you’re unsure, please ask us.

Quotes and more information

In most cases we are only able to assist with tool insurance when you also hold public liability insurance via Trade Risk.

You will typically find this is the same with most insurance brokerages and insurance companies.

If you’re an existing Trade Risk client we can certainly help you out, and if you’re a new client wanting to include both public liability and tool insurance, we can certainly assist there too.

If you would like to obtain a quote on your tool insurance or would just like some extra information, please complete our online quote request or call us on 1800 808 800.